Power, VCs, and entrepreneurs

- Jan 24, 2019

- 10 min read

Updated: Aug 23, 2020

The following blog post is an extended essay that analyzes the power dynamics between entrepreneurs and venture capitalists through an anthropological framework. I wrote this paper under the supervision of Hector Beltran.

An Exploration of the Power Dynamics between Entrepreneurs and Venture Capitalists

In modern day, Silicon Valley and the success of startups have taken center stage in conversations about the future of our economy. Five of the six largest companies in the world are technology companies (CNBC), and the success of such companies are attributed to the skill of entrepreneurs or sometimes, luck. However, one aspect that is not often mentioned but is crucial to the success of any technology company is the relationship between entrepreneurs and venture capitalists. While entrepreneurs are the individuals who come up with an idea and develop the product, venture capitalists are investors who believe in the entrepreneur and help them turn the product into a sustaining company by advising and investing in them. The power dynamics between the two stakeholders are vital in scaling up a company, which have strong repercussions on the cultural dynamics within Silicon Valley as a whole.

The concept of power is heavily analyzed in the texts The History of Sexuality by Michel Foucault, The Field of Cultural Production, Or: The Economic World Reversed by Pierre Bourdieu, and The Three Types of Legitimate Rule by Max Weber. While each author differs in his definition and approach to the concept of power, they all add immense value in understanding how power dynamics can be studied between entrepreneurs and venture capitalists. Additionally, blog posts from Fred Wilson, one of the country's leading venture capitalists and former visiting lecturer at Princeton University, also reveal a deep level of first hand insight to how an individual in the industry views the power dynamics in this relationship. Alongside these four texts, an etic ethnography study will be conducted by interviewing several entrepreneurs and venture capitalists, to use as examples throughout the essay. Utilizing the works of the aforementioned authors and my primary research, I will develop a model to examine the constantly shifting power dynamics between entrepreneurs and venture capitalists.

The ideals discussed by Bourdieu put in context the power dynamics between entrepreneurs and venture capitalists. In The Field of Cultural Production, Or: The Economic World Reversed Bourdieu proposes a very structural model for understanding power and defines several key concepts that he consistently refers to. Bourdieu defines the field as “the space of literary prises de position that are possible in a given period in a given society” (311). This illustrates how Bourdieu views the field as a type of social organization that divides the world. Each field is made up of smaller parts where within each there are agents, positions, hierarchies and power dynamics. Establishing the startup eco-system as its own field is the starting point in exploring the power dynamics that exist within it. In his text, Bourdieu primarily uses the literary and artistic field to cite examples. His diagram of the field is displayed below:

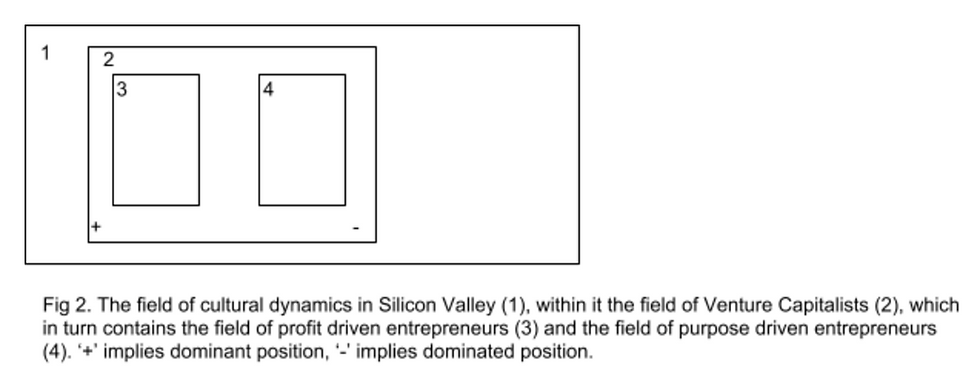

Understanding Bourdieu’s diagram (Bourdieu 319) is key to mapping out a similar model for the startup field. In his diagram, the outermost field is the field of class relations, within it is the field of power which in turn contains the artistic field. Bourdieu claims that artists who are self-motivated have more power, which is indicated by the + symbol, but he also claims that “success, as measured by indices such as book sales, number of theatrical performances, etc. or honours” (Bourdieu 320). Therefore, he makes a distinction between artists creating art for art's sake, and artists who are looking to make a profit. Similarly in Silicon Valley, a distinction can also be made between entrepreneurs who are focused on profit and those who are purpose-driven. The distinction between purpose-driven and profit-driven entrepreneurs is that the former are defined by their internal motivations to solve a social problem through their startup. It can be assumed that entrepreneurs who are focused on profits lack the same power when negotiating with venture capitalists compared to entrepreneurs who are building a company for a larger purpose. This is because entrepreneurs who are purpose-driven are less concerned with making profits and so, do not rely on the constant inflow of capital. However, entrepreneurs who are motivated by profits constantly need venture backing to feel fulfilled and venture capitalists realize this. Reasoning from these principles, the following model can be developed to understand the power dynamics between the two stakeholders.

Figure 2 presents the initial model developed to model the relationship between entrepreneurs and venture capitalists. Both entrepreneurs and venture capitalists are contained within the field of cultural dynamics (1) of Silicon Valley as a whole as this dynamic is echoed throughout the ecosystem. The venture capital field (2) which contains agents who are the venture capitalists have a dominant position illustrated on the diagram. Entrepreneurs who are purpose-driven (3) have a more dominant position than those who are profit-driven (4) in the power dynamics with venture capitalists. As Bourdieu states, it is not effective to only view “visible interactions between individuals, at the expense of the structural relations” (Bourdieu 311). This conveys his belief that examining only the individual is not productive, as the individual means nothing unless put into a relational universe. The model developed depends heavily on relational thinking and the interactions between the two stakeholders. Entrepreneurs and venture capitalists can be seen as components that depend on each other and each component has to exist in relation to one another in order to generate an effect on the cultural dynamics of Silicon Valley as a whole.

The first interview subject is Niels Oggel - Oggel is a visiting entrepreneur at the Sutardja Dai Center for Entrepreneurship and Technology. In his hometown of the Netherlands, Oggel and two other associates started a company to solve the problem of online tutoring for high school students. Oggel has had experience negotiating with venture capitalists, and during an interview he was asked to discuss his company, as well as his dealings with venture capitalists. When asked what were the power dynamics between his team and the venture capitalist they negotiated with, Oggel said “It was a friendly talk, we knew each other from beforehand. He was willing to help us but not yet to invest money. The VC (venture capitalist) had more leverage and was holding the power - he had more experience, and was asking all the questions and I was the one answering questions.” In this particular case, Oggel, due to his lack of experience, did not hold much power in the negotiations. Oggel also said that “the business was purely profit driven, we wanted to monetize by solving a problem.” When asked to clarify how he thinks about the difference in power dynamics between profit-driven entrepreneurs and purpose-driven entrepreneurs, Oggel believes that “for profit driven, focus is more on making money. For purpose driven entrepreneurs it is a more friendly conversation about making the world better, and they can lead the conversation better. So negotiations are easier for entrepreneur who are purpose driven.” This is a great example of how a true entrepreneur views the power dynamic similarly to how it is presented in the model.

Conversely in The History of Sexuality, Foucault has a different interpretation of power. Foucault believes that power is everywhere and is produced - “from one moment to the next, at every point, or rather in every relation from one point to another” (Foucault 93). This shows that Foucault believes power is not something possessed, but rather aggregated from relations. The previously described model in figure 2 assumes that power is stagnant. Foucault's theory of power can be incorporated to develop a more complex model that takes into account the dynamic nature of the agents. As Foucault suggests, the true relationship between entrepreneurs and venture capitalists is indeed always evolving. In the initial stages of the relationship, the power dynamic may be effectively modeled by figure 2, but as soon as venture capitalists choose to invest in an entrepreneur, the local center of power is changed. The power allocation shifts in favor of the entrepreneur as once they receive funding, it is up to them to run the company. The success of the company is now in the best interest of both parties, but the responsibility is placed primarily on the entrepreneur. Thus, incorporating Foucault’s theory into the model allows it to become more dynamic. The constant shifts in power dynamics are the same for both types of entrepreneurs I have presented profit-driven and purpose-driven entrepreneurs. When either type of entrepreneurs receive funding, the power dynamics shift into their favor.

Further examples of this point can be seen in an interview with Davey Bloom. Bloom is an Investment Partner at Dorm Room Fund and a Founding Associate at The House Fund, two of the most active venture capital funds on the UC-Berkeley campus. When asked to describe the power dynamics between venture capitalists and entrepreneurs before and after funding, Bloom agreed with Foucault’s theory power:

“I think at the early stage the power dynamics are slightly in the venture capitalist favor. When an entrepreneur is looking for his/her first check they are completely dependent on the venture capitalist. If the VC says no then there may be no option but to stop working on the company. However as entrepreneurs raise more and more money, they begin to have the leverage. VC's are now fighting to get in the deal, and the entrepreneur can pick and choose who they want to work with” (Bloom).

This quote clearly exemplifies, based on Bloom’s past experiences, he also feels as though successful fundraising can shift the balance of power. When asked if he believes this applies to both profit and purpose driven entrepreneurs, Bloom said “Without a doubt, no matter the goal of the entrepreneur, receiving funding shifts power drastically” (Bloom). Consequently, this aligns directly with the model developed so far.

Additionally, Max Weber, a renowned german sociologist, writes about the three types of legitimate rule - a concept that can also be applied to the model. Weber discusses power extensively in his work The Three Types of Legitimate Rule but rather than explicitly stating the concept of power, Weber discusses the term domination. He describes domination "as the probability that certain specific commands (or all commands) will be obeyed by a given group of persons" (Weber 212). Therefore, the term domination is very closely associated with the concept of power that the model was formed around. In his text, Weber closely analyzes three types of rulers: legal authority, traditional authority and charismatic authority. Charismatic authority is defined as "resting on devotion to the exceptional sanctity, heroism or exemplary character of an individual person, and of the normative patterns or order revealed or ordained by him" (Weber 215). Weber thought power is held by a charismatic individual with superior abilities; this further exemplifies the developed model that power is constantly shifting between entrepreneurs and venture capitalists. As conveyed by Weber in his text, power sometimes shifts to individuals who are more charismatic. Consequently, in the relationship between entrepreneurs and venture capitalists depends on the specific situation - whichever party is more charismatic could see a power shift in their favor, adding to the constantly shifting power dynamic.

In an interview with Wycliffe Aluga, a serial entrepreneur who has founded over ten companies, he discusses his experience negotiating with venture capitalists. Aluga says “in the beginning the VC holds the power and will be intimidating but a good entrepreneur in the time he/she has with the VC should turn it into a level ground. The VCs will stop being intimidating and become a partner, a great entrepreneur shifts the power.” When asked to clarify further what aspect of the entrepreneur can cause a shift in power, Aluga says “mastery of emotional intelligence.” Aluga’s experience in the world of venture capital is a clear example of Weber’s theory played out in the real world. The “mastery of emotional intelligence” is another way of characterizing the charisma entrepreneurs have. Entrepreneurs with more charisma, are able to negotiate better with venture capitalists, shifting the power dynamics in their favor.

Fred Wilson, founding partner at Union Square Ventures and one of the most prominent venture capitalists today, has been writing a blog post every day since 2003. In his post “What Makes For The Most Productive Management-VC Partnership,” Wilson details key characteristics that makes the relationship successful. Wilson writes that venture capitalists “should not ever act like the entrepreneur works for you. Because they don't. If anything, the VC works for the entrepreneur” (Wilson). This conveys how Wilson, after his years of experience in the startup world, believes that the power dynamics should favor the entrepreneur. This contradicts the model that has been developed so far. Although this opinion is not shared throughout the industry, Wilson describes this as the ideal situation, not what currently exists in the industry. Wilson goes on to explain that the “relationship must be as peers who respect each other and are working together to get to the right answers. This is a partnership not a boss/subordinate relationship.” Again, this is Wilson describing the optimal scenario and what works best; this does not necessarily detail what goes on in the real world. The model that shows the constant shifting power dynamics is a closer approximation to the relationship that exists in the industry.

Overall, upon an initial examination of the startup industry, it is easy to conclude that venture capitalists hold more power as they control the money supply. Nevertheless, this idea was proven wrong by how Wilson describes the ideal power dynamic between entrepreneurs and venture capitalists. After incorporating the ideals of Bourdieu, Foucault and Weber, a model was developed that explains the true power dynamics between the two stakeholders. As illustrated in figure 2, in a static state the entrepreneurs who are purpose-driven hold a more dominant position compared to profit-driven entrepreneurs. But after incorporating Foucault’s theory of power, the local centers of power change with time and the model becomes more dynamic. Additionally, Weber’s concept of the charismatic leader also adds further movement in power relations, depending on case-specific characteristics of the entrepreneur and venture capitalists. Further interviews with various entrepreneurs and venture capitalists also supported the ideas developed to form the model. While the individuals interviewed are not representative of the startup field as a whole, they were able to provide unique first-hand insight into what goes on in the real world and how this relates to the model developed. Fundamentally, the importance in this relationship cannot be overstated as it plays a key role in shaping the Silicon Valley ecosystem. Moving forward, it is important to consider the impact this power dynamic has on the rest of the ecosystem and from there to start shifting the power dynamic to an ideal state.

Works Cited

Bourdieu, Pierre. The Field of Cultural Production, Or: The Economic World Reversed. 1994. Print.

Kiesnoski, Kenneth. The Top 10 UC Companies by Market Capitalization. March 2017. CNBC.

Foucault, Michel. The History of Sexuality,Volume 1: An Introduction. 1976. Print.

Weber, Max. The Three Types of Legitimate Rule. 1958. Print.

Wilson, Fred. What Makes For The Most Productive Management-VC Relationship. 2013. Blog Post.

Comments